You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

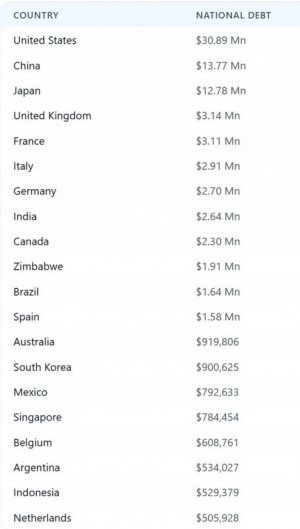

National debt tops 31 Trillion for the first time

- Thread starter ohioboy

- Start date

papa tiger

Well-known Member

Actually, probably the economics guys across the mostly Crooked scape get capped.This country is doomed!!

I remember the Union and Jimmie Hoffa. He got capped.

--------------------------

Its mostly a proven fact that once the person reaches real power, power corrupts & overcomes them.

Maybe they lean Liberals (communist? / what ya call it; ("give it all away") or Dictator, some sort of Autocrats dream, does it really matter?

They know not what to do but blow tax payers & spend all their moneys.

Last edited:

againstthegrain

Well-known Member

- Location

- Sun Valley, ID

Looking forward to all the new tax cuts, like the deduction for interest on car loans, no tax on SS, and no limits on SALT!

Of course in 2033 SS benefits face a 20% cut across the board as it stands now.

Of course in 2033 SS benefits face a 20% cut across the board as it stands now.

Brookswood

Senior Member

And the above is something that both parties ignored in the recent election.Of course in 2033 SS benefits face a 20% cut across the board as it stands now.

Keep in mind that doing nothing will result in an automatic reduction in SS benefits in the 2030’s. By doing nothing both parties are effectively supporting this reduction in benefit, IMO.

Aunt Bea

SF VIP

- Location

- Near Mount Pilot

No point in getting excited until we see who is part of the new administration and hear the particulars of their plans.

My hope is that once some of these things are looked at seriously there will be enough existing checks and balances to limit the scope and the impact.

Time and inflation have always been the enemy of old folks on a fixed income.

My hope is that once some of these things are looked at seriously there will be enough existing checks and balances to limit the scope and the impact.

Time and inflation have always been the enemy of old folks on a fixed income.

There is a person on Reddit who has provided some really helpful financial insights the past couple years and this is his current musings:

Yields continued to rise after the market open and ahead of the 30 year bond auction today. With a new administration taking over, I would not be surprised if someone in the new administration suggests "inflating out of debt" at much faster pace than what is going on now. (see comments).

"Inflating out of debt" and how it would work:

- The government has about $27 trillion of debt held by the public T-Bills, TIPS, notes, bonds FRN.

- Inflation is the general increase in prices of goods and services in an economy over time. When inflation occurs, the purchasing power of a currency decreases, meaning that each unit of currency can buy fewer goods or services.

- If a government wants to reduce the real value of its debt, it may intentionally create inflation by adopting expansionary monetary policies. These policies could involve increasing the money supply, lowering interest rates, or engaging in quantitative easing.

- As inflation rises, the nominal value of the outstanding debt remains the same, but the real value of the debt decreases. This is because the debt's value is eroded by the decrease in the purchasing power of the currency.

- In an inflationary environment, governments may find it easier to repay their debt obligations. Since the value of money is decreasing, they can effectively repay their debt using currency that is worth less than when the debt was initially incurred.

The Treasury has been buying back debt issued in 2020/2021 as low as 55 cents on the dollar. If they brought rates up to 6-8%, some of the outstanding bonds and notes could be purchased at 30-50 cents on the dollar. The losers would be funds, any banks, and insurance companies that are holding that debt. Retail investors can take advantage of the temporary rise in yields and lock returns.

Navigating through this period involves looking at both government fiscal policies and the state of the overall economy moving forward. Kicking the can down the road will ensure a higher for longer environment. The strategy going forward is to catch the next peak in interest rates and lock some duration 5-10 years before the next economic downturn which could be pretty severe for the 60% who live paycheck to paycheck.

HermitHogan

Senior Member

- Location

- 3rd Stone from the Sun

If federal programs are cut, as is being proposed, that will put a lot of people out of work. One of the problems today is that there's a worker shortage in almost all industries, so it's possible those people can be retrained to fill some of the vacancies. That will reduce demand for workers and bring wages down.

That's the theory, anyway.

That's the theory, anyway.

papa tiger

Well-known Member

Most government workers make good money. So, they sling hamburgers later. Not gonna happen.

The Fed currently employes around 2,000,000. Cutting 500,000 just means they moved. The projected growth rate of employment is 6.7 million in the next 10 years. Health care and Social Assistance could be the main drivers. In those same 10 years more will have died then were fired.

Most all born after the 1930's till the 60's are dead, dying or on the list to pass soon.

Around 3.5 million die every year. That makes 35,000,000 leaving Social Security and Medicare by the early 2030's & as the aged begin to die more quickly it may be much higher. Lots of 80's - 90's out there.

World wide;

Today, there are 703 million people aged 65 or older, a number that is projected to reach 1.5 billion by 2050. According to the latest population estimates and projections from UN DESA’s Population Division, 1 in 6 people in the world will be over the age 65 by 2050, up from 1 in 11 in 2019.

It's sort of obvious the retirement age will raise to 75 way before then baring a glaring physical or mental handicap. You know the happy pill from the drug company will keep em hopping for another 20 years.

The glaring question is, "What's going to happen to the Cruise lines when all the Seniors are still Working and not living on their boats."

How about the early-bird breakfast meetings at Hardies. All the empty Senior centers. The strolls in the parks. Fishermen? 1/2 the mid morning early afternoon autos on the boulevards.

Think of the cavalcade of powerchairs, walkers going down sidewalks, across 4-ways etc. loading in parking lots and all at rush hours.

Millions of buses, elevated trains and subways crammed with em. Today I see 3 on powerchairs, one crossing the road and railroad tracks.

2 on 3-wheel electric bicycles & around 40 shopping at waldo world, two sitting in the park by the lake.

By 2050 the world will be a MESS !

I remember looking down from a Screw Converor system, I'm working on the motor Drive gearing system & over 100' off the pavement, thinking, if I fell here, my safety fall system fails and I die.

I'm 63 love my job, If I'm in my early 30's I would keep at it forever. But that all seems dumb if I fall next time I'm up here.

The Fed currently employes around 2,000,000. Cutting 500,000 just means they moved. The projected growth rate of employment is 6.7 million in the next 10 years. Health care and Social Assistance could be the main drivers. In those same 10 years more will have died then were fired.

Most all born after the 1930's till the 60's are dead, dying or on the list to pass soon.

Around 3.5 million die every year. That makes 35,000,000 leaving Social Security and Medicare by the early 2030's & as the aged begin to die more quickly it may be much higher. Lots of 80's - 90's out there.

World wide;

Today, there are 703 million people aged 65 or older, a number that is projected to reach 1.5 billion by 2050. According to the latest population estimates and projections from UN DESA’s Population Division, 1 in 6 people in the world will be over the age 65 by 2050, up from 1 in 11 in 2019.

It's sort of obvious the retirement age will raise to 75 way before then baring a glaring physical or mental handicap. You know the happy pill from the drug company will keep em hopping for another 20 years.

The glaring question is, "What's going to happen to the Cruise lines when all the Seniors are still Working and not living on their boats."

How about the early-bird breakfast meetings at Hardies. All the empty Senior centers. The strolls in the parks. Fishermen? 1/2 the mid morning early afternoon autos on the boulevards.

Think of the cavalcade of powerchairs, walkers going down sidewalks, across 4-ways etc. loading in parking lots and all at rush hours.

Millions of buses, elevated trains and subways crammed with em. Today I see 3 on powerchairs, one crossing the road and railroad tracks.

2 on 3-wheel electric bicycles & around 40 shopping at waldo world, two sitting in the park by the lake.

By 2050 the world will be a MESS !

I remember looking down from a Screw Converor system, I'm working on the motor Drive gearing system & over 100' off the pavement, thinking, if I fell here, my safety fall system fails and I die.

I'm 63 love my job, If I'm in my early 30's I would keep at it forever. But that all seems dumb if I fall next time I'm up here.

Last edited:

dilettante

Well-known Member

- Location

- Michigan

I've heard that some Federal offices will be relocated out of the D.C. area into more central regions of the country. I'm sure some workers will relocate, while others could be taken over by replacements locally. Since the cost of living is more reasonable, this dispersion might help those areas with primary and secondary jobs (housing, grocery, etc.) while also reducing the payroll total cost to taxpayers.If federal programs are cut, as is being proposed, that will put a lot of people out of work. One of the problems today is that there's a worker shortage in almost all industries, so it's possible those people can be retrained to fill some of the vacancies. That will reduce demand for workers and bring wages down.

But I wouldn't be shocked to see some staffing levels cut and other employees choosing not to relocate. The challenge with these surplus former-Feds is whether they have the skills for any other employment.

Murrmurr

SF VIP

- Location

- Sacramento, California

I don't know why, but that made me lol.... The challenge with these surplus former-Feds is whether they have the skills for any other employment.

(actually, I know why)

The problem with federal agencies and programs is they waste a ton of money. Billions a year. Plus their built-in bureaucracy makes them ridiculously slow, and the lack of oversight and interdepartmental communication and coordination makes them woefully inefficient. Plus, a lot of them are redundant and/or outdated, so it's no wonder billions of dollars is flushed down the toilet every year.

A lot of the "work" federal agencies and programs do can be done a whole lot better by private companies; faster, more efficiently, and with more modern methods. All that = progress, progress = growth, and growth = jobs...which = progress.

Most Americans are convinced that inflation, and mostly, the price of gasoline and groceries, are under the direct control of the president.The other shoe:

The Great Melt-Up: Why The USA is Choosing Hyperinflation

papa tiger

Well-known Member

In the last 20 years prices have increased at least 4x.

--------

Ladies the decentralization, it's been going on for a long time.

NGA breaks ground on new facility in north St. Louis | National Geospatial-Intelligence Agency

--------

Geospatial intelligence - Wikipedia

-------------------

The National Personnel Records Center - A History

---------

Areas of large City, buildings falling down become Departments in Government of the peoples.

Thought the FBI was doing that. Obviously, someone's watching !

-------

--------

Ladies the decentralization, it's been going on for a long time.

NGA breaks ground on new facility in north St. Louis | National Geospatial-Intelligence Agency

--------

Geospatial intelligence - Wikipedia

-------------------

The National Personnel Records Center - A History

---------

Areas of large City, buildings falling down become Departments in Government of the peoples.

Thought the FBI was doing that. Obviously, someone's watching !

-------

Last edited:

AnnieA

Well-known Member

- Location

- Down South

A single subject rule in Congress would fix the budget problem over time.

dilettante

Well-known Member

- Location

- Michigan

They aren't. But that's not what the video is about at all.Most Americans are convinced that inflation, and mostly, the price of gasoline and groceries, are under the direct control of the president.

Don M.

SF VIP

- Location

- central Missouri

There's an Old Saying that holds a lot of truth, "Those who can, DO....Those who Can't, go to work for the Government".The challenge with these surplus former-Feds is whether they have the skills for any other employment.

I didn't say I was referring to the video, but thanks for the input.They aren't. But that's not what the video is about at all.

gruntlabor

Well-known Member

- Location

- Last Frontier, Age 83

.. or teach.There's an Old Saying that holds a lot of truth, "Those who can, DO....Those who Can't, go to work for the Government".

Knight

Well-known Member

31 trillion as if that were money for a child to buy ice cream with. A serious amount but of more concern is the deficit.

October 18, 20241:56 PM PDTUpdated 22 days ago

WASHINGTON, Oct 18 (Reuters) - The U.S. budget deficit grew to $1.833 trillion for fiscal 2024, the highest outside of the COVID era, as interest on the federal debt exceeded $1 trillion for the first time and spending grew for the Social Security retirement program, health care and the military, the Treasury Department said on Friday.

The deficit for the year ended Sept. 30 was up 8%, or $138 billion, from the $1.695 trillion recorded in fiscal 2023. It was the third-largest federal deficit in U.S. history, after the pandemic relief-driven deficits of $3.132 trillion in fiscal 2020 and $2.772 trillion in fiscal 2021.

https://www.reuters.com/markets/us/us-budget-deficit-tops-18-trillion-fiscal-2024-third-largest-record-2024-10-18/#:~:text=The deficit for the year,$2.772 trillion in fiscal 2021.

I doubt I'll live long enough to feel the impact of what will happen when those the U S government is indebted to demand payment.

IMO the foreign debt will be paid 1st. eventually leaving Soc. Sec. Medicare & Medicaid funding significantly less.

October 18, 20241:56 PM PDTUpdated 22 days ago

WASHINGTON, Oct 18 (Reuters) - The U.S. budget deficit grew to $1.833 trillion for fiscal 2024, the highest outside of the COVID era, as interest on the federal debt exceeded $1 trillion for the first time and spending grew for the Social Security retirement program, health care and the military, the Treasury Department said on Friday.

The deficit for the year ended Sept. 30 was up 8%, or $138 billion, from the $1.695 trillion recorded in fiscal 2023. It was the third-largest federal deficit in U.S. history, after the pandemic relief-driven deficits of $3.132 trillion in fiscal 2020 and $2.772 trillion in fiscal 2021.

https://www.reuters.com/markets/us/us-budget-deficit-tops-18-trillion-fiscal-2024-third-largest-record-2024-10-18/#:~:text=The deficit for the year,$2.772 trillion in fiscal 2021.

I doubt I'll live long enough to feel the impact of what will happen when those the U S government is indebted to demand payment.

IMO the foreign debt will be paid 1st. eventually leaving Soc. Sec. Medicare & Medicaid funding significantly less.

Aunt Bea

SF VIP

- Location

- Near Mount Pilot

The scary thing to me is that it’s all based on faith in the United States Government.31 trillion as if that were money for a child to buy ice cream with. A serious amount but of more concern is the deficit.

October 18, 20241:56 PM PDTUpdated 22 days ago

WASHINGTON, Oct 18 (Reuters) - The U.S. budget deficit grew to $1.833 trillion for fiscal 2024, the highest outside of the COVID era, as interest on the federal debt exceeded $1 trillion for the first time and spending grew for the Social Security retirement program, health care and the military, the Treasury Department said on Friday.

The deficit for the year ended Sept. 30 was up 8%, or $138 billion, from the $1.695 trillion recorded in fiscal 2023. It was the third-largest federal deficit in U.S. history, after the pandemic relief-driven deficits of $3.132 trillion in fiscal 2020 and $2.772 trillion in fiscal 2021.

https://www.reuters.com/markets/us/us-budget-deficit-tops-18-trillion-fiscal-2024-third-largest-record-2024-10-18/#:~:text=The deficit for the year,$2.772 trillion in fiscal 2021.

I doubt I'll live long enough to feel the impact of what will happen when those the U S government is indebted to demand payment.

IMO the foreign debt will be paid 1st. eventually leaving Soc. Sec. Medicare & Medicaid funding significantly less.

We need to come up with a plan to get our spending and the deficit under control that can survive from one administration to the next.

gruntlabor

Well-known Member

- Location

- Last Frontier, Age 83

Exactly, precisely, indubitably!The scary thing to me is that it’s all based on faith in the United States Government.

Paco Dennis

SF VIP

- Location

- Mid-Missouri

If anything ever needed a reset button, it would be "The Economy".

dilettante

Well-known Member

- Location

- Michigan

It could be worse. It could be Germany, or Canada, or almost anywhere.The scary thing to me is that it’s all based on faith in the United States Government.

HermitHogan

Senior Member

- Location

- 3rd Stone from the Sun

That's nothing. It was over $3 trillion in fiscal year 2020.31 trillion as if that were money for a child to buy ice cream with. A serious amount but of more concern is the deficit.

October 18, 20241:56 PM PDTUpdated 22 days ago

WASHINGTON, Oct 18 (Reuters) - The U.S. budget deficit grew to $1.833 trillion for fiscal 2024, the highest outside of the COVID era, as interest on the federal debt exceeded $1 trillion for the first time and spending grew for the Social Security retirement program, health care and the military, the Treasury Department said on Friday.

The deficit for the year ended Sept. 30 was up 8%, or $138 billion, from the $1.695 trillion recorded in fiscal 2023. It was the third-largest federal deficit in U.S. history, after the pandemic relief-driven deficits of $3.132 trillion in fiscal 2020 and $2.772 trillion in fiscal 2021.

https://www.reuters.com/markets/us/us-budget-deficit-tops-18-trillion-fiscal-2024-third-largest-record-2024-10-18/#:~:text=The deficit for the year,$2.772 trillion in fiscal 2021.

I doubt I'll live long enough to feel the impact of what will happen when those the U S government is indebted to demand payment.

IMO the foreign debt will be paid 1st. eventually leaving Soc. Sec. Medicare & Medicaid funding significantly less.

papa tiger

Well-known Member

Basically everything is doubling in price every 4 years now.

Look to expect Doubling every 3 years soon.

It's just because of spending on total crap ideas.

Sure, that's a no-nonsense answer to stupidity!

It's so easy to spend majority taxpayers into absolute insolvency.

--------------

Someone once said the Taxpayer majority will always allow us to spend more!

-----------

Soon a $125,ooo F150 base priced offer.

Look to expect Doubling every 3 years soon.

It's just because of spending on total crap ideas.

Sure, that's a no-nonsense answer to stupidity!

It's so easy to spend majority taxpayers into absolute insolvency.

--------------

Someone once said the Taxpayer majority will always allow us to spend more!

-----------

Soon a $125,ooo F150 base priced offer.

Last edited: